This benchmark value will be of great interest to Australian tree growers who many now be considering whether to register their own projects for subsequent ERF auctions. It also interests me, especially from the perspective of comparing options for registration of carbon from Australian afforestation projects - would it be better to submit a project for the next ERF auction assuming the same value of $14/t can be attained, or would it be better to target the voluntary market and Gold Standard certification?

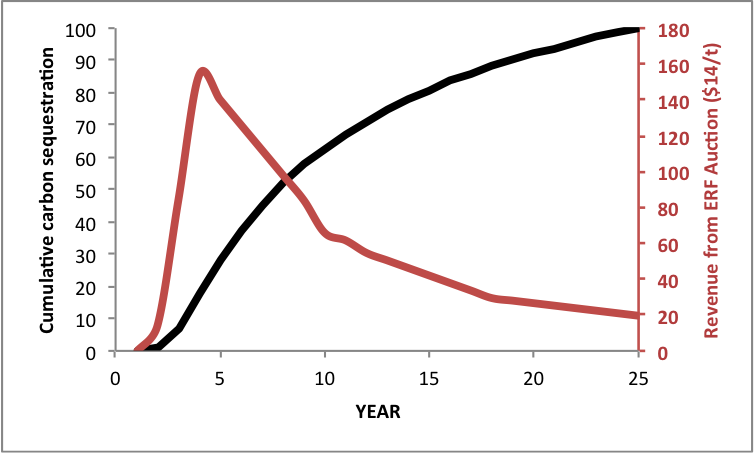

The first important point of difference between the options is that Gold Standard carbon registration allows for revenues from ex-ante carbon (i.e. future carbon sequestration that can justifiably be expected throughout the entire project lifetime). This means that a single up-front payment can be expected from selling Gold Standard certified carbon rather than having to wait for biomass accumulation. How much is this worth in a financial analysis? To answer that question I modelled a hypothetical afforestation project. I assumed a reasonable biomass growth curve representing the accumulation of 100 t of carbon in a 25-year period (see the black line in Figure 1). The resulting payments from an ERF bid of $14/t are presented as the red line in Figure 1.

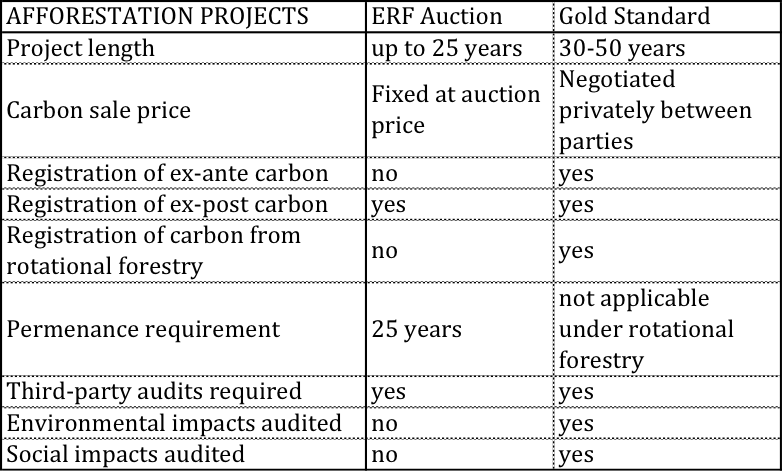

There are obviously other points of difference between the ERF and Gold Standard options for Australian carbon and I have summarised these in the table below. The best option for an afforestation project will depend on its particular characteristics. The following advantages of carbon registration with The Gold Standard may apply to some projects:

- Gold Standard certification is possible for rotational forestry;

- Gold Standard certification allows for projects of up to 50 years so the value of ex-ante carbon from slower-growing species can be maximised.

The following advantages of project registration with the ERF may apply to other projects:

- The project developer does not need to arrange the transaction of carbon credits with a buyer if registering for the ERF;

- Auditing under the ERF protocol does not include aspects of environmental and social impacts.

RSS Feed

RSS Feed